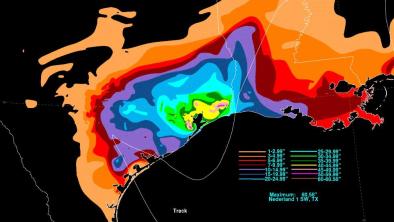

Hurricane Harvey may add to debt woes of U.S. flood insurance program

The destruction that heavy rain and floods from Hurricane Harvey could inflict on Texas would add to the pile of debt owed by a federal flood insurance program that is due to expire in September, advocacy groups said.

The National Flood Insurance Program (NFIP) owes $24.6 billion to the Treasury. Most of it covered claims from Hurricane Katrina in 2005, Superstorm Sandy in 2012, and floods in 2016, the program’s third most severe loss-year on record with losses exceeding $4 billion, according to the Federal Emergency Management Agency (FEMA), which manages it.

The NFIP was extended 17 times between 2008 and 2012 and lapsed four times in that period. A 2012 law extended the program to September.

The only source of flood insurance for most Americans, it will be in place for homeowners and businesses in Harvey’s path along the central Texas coast.

Related Content